Understanding Tenant Improvement Allowance: What You Need to Know

Introduction

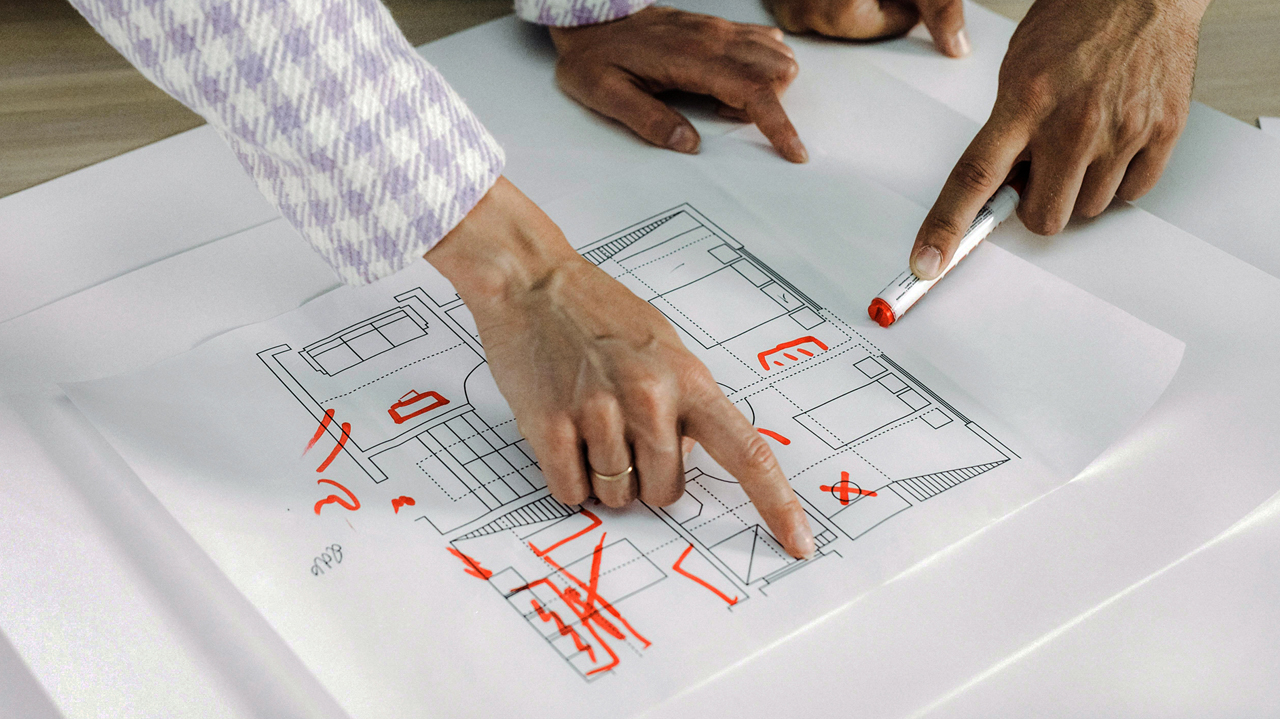

While considering relocating to a new space, tenant improvement allowance is a crucial term to negotiate. It is one of the most common features of commercial real estate leases where modifications or improvements are required. Tenants often need to renovate spaces according to their business necessities. Tenant Improvement Allowance can cover some or most of the construction costs regarding the reconstruction. The landlord pays the TI allowance to its tenant according to the lease agreement signed between them. A tenant rep broker will typically suggest to the tenant that they include a tenant improvement allowance in the lease while negotiating the terms so that they can receive the funding they require for the desired upgrades. So it’s a negotiated sum of money a landlord provides to a tenant to improve a commercial property. The tenant can use this allowance to make alterations or renovations to the property, such as installing new floors, walls, or fixtures, or to make other changes to the property to meet the tenant’s specific needs. Tenant improvement allowances are typically provided to tenants as an incentive to lease a property. They are intended to help the tenant create a suitable space for their business. The amount of the allowance may be based on the size and condition of the property, as well as the tenant’s specific improvement needs. Tenant improvement allowances are usually provided as a lump sum payment or credit towards the tenant’s rent. Landlords may also require tenants to return the property to its original condition when they vacate the space, which may require the tenant to pay for any improvements made using the tenant improvement allowance.

Why Do Landlords Provide Allowance?

Tenant Improvement Allowance is also known as TI, TIA, or TA. Landlords may require tenants to provide detailed plans and specifications for the proposed improvements before approving the tenant improvement allowance. The tenant is usually responsible for hiring contractors and managing the improvement project, but the landlord may need to sign off on specific aspects of the work. Tenant improvement allowances may be used to cover the cost of materials, labor, and other expenses related to the improvements. The tenant may need to provide documentation, such as receipts or invoices, to show how the tenant improvement allowance was used. TIA may be subject to taxes, depending on the specific terms of the lease agreement and local laws. It is typically calculated in per square foot amount. Property owners often provide TI allowances to entice qualified tenants to lease their available properties. A number of variables, including the rental fee, the property’s location, the lease’s length, the building’s quality, the tenant’s creditworthiness, etc., determine the amount of the tenant improvement allowance. For instance, let’s consider a 3,000 SF office space leased to a tenant where the landlord has agreed to provide $15 per square foot as a tenant improvement allowance. This means the landlord will provide a total of $45,000 as TIA to cover the expenses such as new carpet, new paint, new windows, ceiling modifications, etc., and it can even cover the moving costs. What the TIA can and cannot cover is usually finalized by the negotiation between the landlord and the tenant, and those details are stated in the lease terms. Although paying back the TIA to the landlord is not required, the landlord typically incorporates a fraction of the TI with the base rent or elongates the lease duration to offset the cost.

Get the most out of your lease — get expert guidance!

Schedule a Discovery CallMechanism & Coverage

A tenant representation broker may be able to negotiate an exceptional improvement allowance that might cover the majority of the upgrade expenditures. However, it’s a common misconception that TI allowances will cover all the costs of constructing the space. Except if the upgrades are minimal and the deal terms permit to cover those upgrades, it is most likely that the tenant improvement allowance will not cover the whole construction upgrade. Remembering that a renter must be ready to pay for necessary upgrades initially is crucial. The landlord will reimburse the negotiated allowance when the renovations are complete based on the completion documentation, such as bill copies. Depending on the terms of the lease agreement negotiated between the landlord and the tenant, the tenant improvement allowance may cover a number of costs. How the allowance can be used is also mentioned in the lease agreement. Typically, landlords agree to foot the bill for expenses to raise the property’s value in the long run. The TI includes hard and soft costs that landlords normally agree to finance:

Hard Costs: Hard costs refer to costs related to improvements or modifications to the leased space that will be made to the property, which will become a permanent part of that property and improve the market value of the landlord’s property. Depending on the particular leasing agreement, the hard costs that the TIA may cover can vary but usually involve:

- Structural modification of the building. Example: Adding doors and windows or removing walls etc.

- Demolition of existing buildings or fixtures and their removal.

- New flooring installation or replacement, installing or modifying the HVAC system

- New painting and wall finishes, plumbing upgrades or modifications

- Security system installation, electrical system upgrade or modification

- Installation of signage, fire safety upgrades or modifications

- Lighting installation, upgrades or modifications, ceiling upgrades or modifications, etc.

Soft Costs: Soft costs are often defined as expenditures associated with the design, construction, consultation, and management of the improvement project, which are not directly related to the construction or equipment. Soft expenses are crucial to consider in any project because they can considerably affect the total project cost and schedule. Some of the soft costs that TI may cover are given below:

- Architectural or Engineering design fees

- Fees for different permits and legal fees to be paid to the lawyer

- Project management fees, etc.

Limitations of TI

In certain situations, the landlord controls and manages the tenant improvement work, specifically if the space is limited and the TI is minimal. If the tenant requires any particular design or structure for the renovation process, a general contractor can be appointed to manage the tenant remodeling process. Most of the time, landlords and managers of commercial properties are familiar with trustworthy contractors to whom they might direct potential tenants. Before beginning the upgrades, it is crucial to obtain the landlords’ approval and keep them informed of the status of the work. While landlords agree to pay for some hard and soft costs that might eventually benefit them, landlords rarely approve paying for additional expenses that are not functional or appealing, or that can be removed; in other words, costs that are not going to benefit them (the landlords) when the tenants leave. Some costs which the tenant improvement allowance may not cover are:

- Expenses related to upgrades personalized to the tenant’s particular requirements or interests.

- Maintenance and repair expenses that are required on a regular basis.

- Expense due to improvements to temporary furnishings like furniture and removable partitions.

- Unforeseen problems that demand extra labor or supplies could occur during construction.

- Repairment costs the tenant brings, like damaged fixtures, equipment, etc.

How The Negotiation Should Be Done

A tenant should demonstrate their financial responsibility by providing several years’ worth of tax returns and financial documents for assessment to negotiate with a landlord on favorable terms and circumstances. It shows how creditworthy the tenant is. Landlords often provide TIA to attract tenants, almost always up for negotiation. When the landlord and tenant reach an agreement, the TIA amount should be checked by the commercial tenant broker during the lease agreement review. To get the most out of a TI negotiation, a tenant can follow these tips:

Doing the homework: Since there are many factors like location, size of the property, lease length etc., which have an impact on the amount of TIA, it is important for any tenant to find out what tenant improvement allowances are frequently provided in the submarket and for properties with equivalent size and building class by researching the market.

Identifying the requirements: Determining which upgrades and alterations one might need to adapt the space to the business demands is crucial. It will help to estimate the financial requirement.

Presenting a detailed request: During the negotiation process, the tenant should bring a well-thought-out plan and budget for the required upgrades. The tenant should provide the landlord with specific plans and cost projections to support the mentioned requests.

Being flexible: If landlords believe the upgrades would raise the property’s worth and appeal to future renters, they might be more open to providing a greater TIA. To get a bigger allowance, a tenant should be flexible to prolong the lease’s length or increase the rental rate.

TI Alternatives

Many tenants, including start-ups and small business organizations, must pay for improvements upfront and can request refunds after completing the improvement project. It is frequently tricky for the tenant to initially manage the liquid capital to pay for the modifications. To avoid these issues, a few alternatives can be considered:

Rent Concession: To cover the cost of tenant upgrades, a landlord may reduce rent. In exchange for the tenant making changes to the space, the landlord might, for instance, agree to lower the rent for a while or allow a time when it won’t be charged. This helps tenants to avoid rent payments from overlapping with improvement expenses.

Turn-key space: a “turnkey” space is a commercial property fully built-out and ready for immediate occupancy. In other words, a turnkey space is a move-in-ready property that has already been customized and improved to suit the tenant’s needs without the need for additional modifications or improvements. In a turnkey situation, the landlord assumes the responsibility and cost of completing all necessary improvements and modifications to the property. He delivers it to the tenant in a fully finished and functional state. As a result, the tenant does not need to contribute any of their own funds toward improving the space beyond what is included in the lease agreement. However, turnkey spaces may also come with a higher rental rate or longer lease commitment to compensate for the landlord’s investment in the improvements.

Conclusion

When businesses rent commercial space, they may need to make modifications or improvements to suit their specific needs, ranging from minor cosmetic updates to more significant structural alterations. The tenant improvement allowance is a negotiated part of the lease agreement. The landlord agrees to provide a certain amount of money to cover the cost of these improvements, which can be a fixed amount or a specific amount per square foot of the leased space. This allowance typically covers expenses related to construction, materials, labor, and other improvement expenses. The tenant may be responsible for additional costs exceeding the agreed-upon TIA or negotiate a “turnkey” improvement, where the landlord takes on the cost and responsibility of completing the improvements. Once the improvements are completed, the tenant is responsible for maintaining and repairing any alterations made to the property. Tenant improvement allowance can be a valuable tool for landlords to attract and retain tenants, as they can help tenants customize the property to meet their specific needs. However, landlords should be careful to ensure that they are offering an appropriate amount of allowance based on the value of the property and the proposed improvements. So, it is vital to entirely understand all the factors related to TI allowances. Conducting market research, considering all the variables that could impact the TI, determining budgets for the necessary modifications, and prioritizing them- these should all be done correctly to ensure a better TIA and save time and money.

Topic: Commercial Leasing, Tenant Representation

Leverage TI to your advantage – Speak to a broker today!

Talk to a Broker

About the Author - Adam Stephenson, CCIM, SIOR

With over a decade of experience in commercial real estate, Adam is a trusted advocate for privately held organizations, specializing in industrial properties across Central Indiana. Adam brings a wealth of expertise in tenant representation, lease negotiations, and strategic asset acquisitions. A graduate of Indiana University – Indianapolis with a degree in Business Management, he further distinguished himself by earning the prestigious CCIM & SIOR designations. His deep industry knowledge, client-focused approach, and commitment to delivering tailored solutions make his insights invaluable.